Investing. For a better now.

Für unsere Kunden entwickeln wir Anlagelösungen, bei denen die marktorientierte Rendite genauso im Fokus steht wie die soziale und ökologische Performance. Damit wollen wir zum Erhalt unseres Planeten beitragen, den sozialen Fortschritt unserer Gesellschaft fördern und die Nachhaltigkeits-Transformation der Wirtschaft vorantreiben. Als einer der wichtigsten Player im Markt setzen wir Standards. Das erreichen wir durch unsere langjährige Expertise in Credit und Nachhaltigkeit, und durch aktives Engagement.

Beyond sustainable credit

Unsere Kultur

We practice what we preach. Wir setzen uns für die Einhaltung anspruchsvoller Umwelt-, Sozial- und Governance-Standards ein. Respekt, Teamgeist, Offenheit, Solidarität und Professionalität sind die Grundpfeiler unserer Kultur. Es ist unser Anliegen, Erwartungen zu übertreffen und in unserer Branche mit gutem Beispiel voranzugehen.

Umwelt

Soziales

Unternehmensführung

Management

Das Team von ESG-AM zeichnet sich durch langjährige Erfahrung in der Finanzbranche, in Nachhaltigkeit und ESG-Management aus. Wir legen gleichermassen Wert auf Marktrendite und Nachhaltigkeit. Wir haben eine Leidenschaft für nachhaltiges Investieren und bringen vollen Einsatz, um das Vermögen unserer Kunden in die richtige Richtung zu lenken. Durch Optimierung, Innovation und den Dialog mit unseren Stakeholdern steigern wir unsere Performance.

Verwaltungsrat

Unser Verwaltungsrat ist vollkommen unabhängig. Die Mitglieder unseres Verwaltungsrats verfügen über herausragende Fachkenntnisse in den für unser Unternehmen wichtigsten Bereichen – darunter Investment Management, Nachhaltigkeit, Regulierung und Reputationsmanagement.

Reto Schwager

Tonia Zimmermann

Florian Heeb

Cécile Bachmann

David Wyss

Thomas Hirsiger

Partners

Wir bauen auf Partnerschaften, um Daten zu beschaffen und unsere Investitionsanalyse zu untermauern. Bei der Auswertung hingegen verlassen wir uns auf selbst entwickelte Modelle und modernste Technologien.

ISS ESG

ResponsAbility

I-CV

Equileap

RepRisk

itnetX

Produkte

Wir fokussieren uns auf ein konzentriertes Produktangebot für nachhaltige Anlagen im Kreditbereich. Unsere Anlagestrategien priorisieren Marktrendite und Nachhaltigkeits-Performance. Die Themen sozialer Wandel und Klima stehen im Fokus der nachhaltigen Zielsetzungen unserer Anlagestrategien.

ESG-AM High Yield Social Transformation

ESG-AM Multi Credit

rA Transition to Net Zero Corporate Bonds

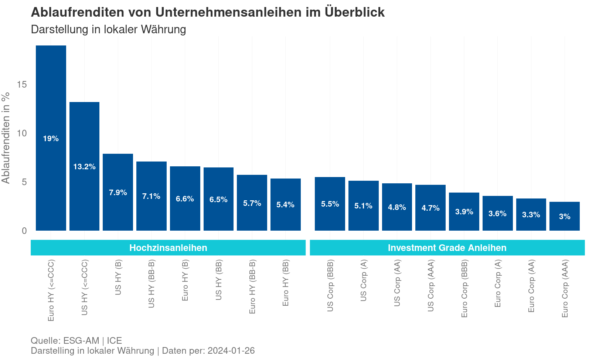

Research

Zusätzlich zu unseren quantitativen Modellen ergänzt fundamentales Research unsere Analysen. Wir teilen die wichtigsten Erkenntnisse mit unseren Kunden und anderen relevanten Stakeholdern.

News

Alle Neuigkeiten über uns und interessante Geschichten aus dem Markt.

Kontakt

Vom Zürcher Hauptbahnhof mit dem Tram Nummer 6, 7 oder 13 zur Station Enge, von da aus 3 Minuten zu Fuss.