MEDIA RELEASE

responsAbility and ESG-AM launch Transition to Net Zero Bond Fund

Zurich, June 22, 2022 – – Until now, impact investing has been almost exclusively the preserve of private markets. That is about to change thanks to the commitment of Swiss sustainable investment firm responsAbility and ESG Asset Management (ESG-AM). The fund, which was licensed for public distribution as of 23 June 2022, enables institutional and private investors to invest in sectors relevant to climate change without compromising on financial performance. The sustainability strategy is structured as an Article 9 fund in accordance with EU SFDR guidelines and is characterized by the fact that it pursues clearly measurable sustainability goals.

The focus is on companies that are taking credible measures to achieve a substantial reduction in CO2 emissions and net zero greenhouse gas emissions in the long term. Around 70% of the bonds in the initial portfolio are allocated across the industrials sectors, which have by far the greatest leverage in reducing greenhouse gas emissions. A further almost 25% of the bonds fall into the financial services sector and around 5% relate to the utility sector. In terms of country allocation, the US (around 40%), UK (13%), Germany (9%) and France (8%) make up the bulk of the portfolio. Switzerland is represented by a handful of bonds, including Holcim. This issuer exemplifies the Transition to Net Zero Bond Fund’s consistent approach to sustainability.

Holcim, innovative driver towards net zero

Cement is one of the most important building materials and is also responsible for around 7% of global CO2 emissions. Most of the emissions come from the decarburization (the decrease of the content of carbon) of the limestone and the high temperatures required for the manufacturing process, which normally result from the combustion of fossil fuels.

As an innovative Swiss building materials company, Holcim is driving change in the industry by developing new types of cements, increasing the use of waste-based fuels and operating pilot plants where unavoidable carbon emissions are captured. Thus, the Holcim cement group, with its concrete net-zero reduction pathway, is a good corporate example targeted by the strategy.

High demand from institutional investors

For the launch of the Transition to Net Zero Bond Fund, initial seed funding has been provided by institutional investors from Germany and Switzerland and the demand from institutional clients continues, including pension funds, banks, insurance providers, family offices and also Fund of Fund Managers that support the climate transition strategy.

For Stephanie Bilo, Chief Client & Investment Solutions Officer at responsAbility, it is clear that “the urgency of decarbonization requires investors to take credible action. However,

the current most widespread approach of corporate exclusions falls short. Excluding carbon- intensive sectors from impact investment may seem obvious, but it does not achieve the goal. On the contrary, it is important to include companies from such sectors. Thanks to the influence of investors, targeted incentives for measures can be set so that companies with large greenhouse gas emissions in particular take effective measures to reduce greenhouse gases. This sets in motion a great leverage effect that can substantially reduce carbon emissions and take us a big step further towards net zero.”

Philipp Good, CEO of ESG-AM, adds, “Our portfolio focuses on issuers through all rating categories, with an initial average rating of BBB, that stand out for having defined specific climate targets and consistently pursuing them. From the investable universe of around 750 issuers, we select those 100 bonds that also stand out for their attractive risk-return profile with a target yield currently in USD of over 5.5%. We are convinced that we can generate an attractive return from a financial and sustainable perspective.”

Susanne Kundert joins ESG-AM as a partner

In the course of the launch of the Transition to Net Zero Bond Fund, ESG-AM has further strengthened the team and brought on board an experienced ESG portfolio manager in Susanne Kundert. Susanne Kundert was most recently Head Credit Specialities in Fixed Income Asset Management at Swisscanto Invest by Zürcher Kanntonalbank. She is a proven specialist in the field of Sustainable Finance with over 20 years of experience in asset management. Susanne Kundert will manage the Transition to Net Zero Bond Fund as responsible portfolio manager and partner of ESG-AM together with Philipp Good, Peter Jeggli and Robert Koch.

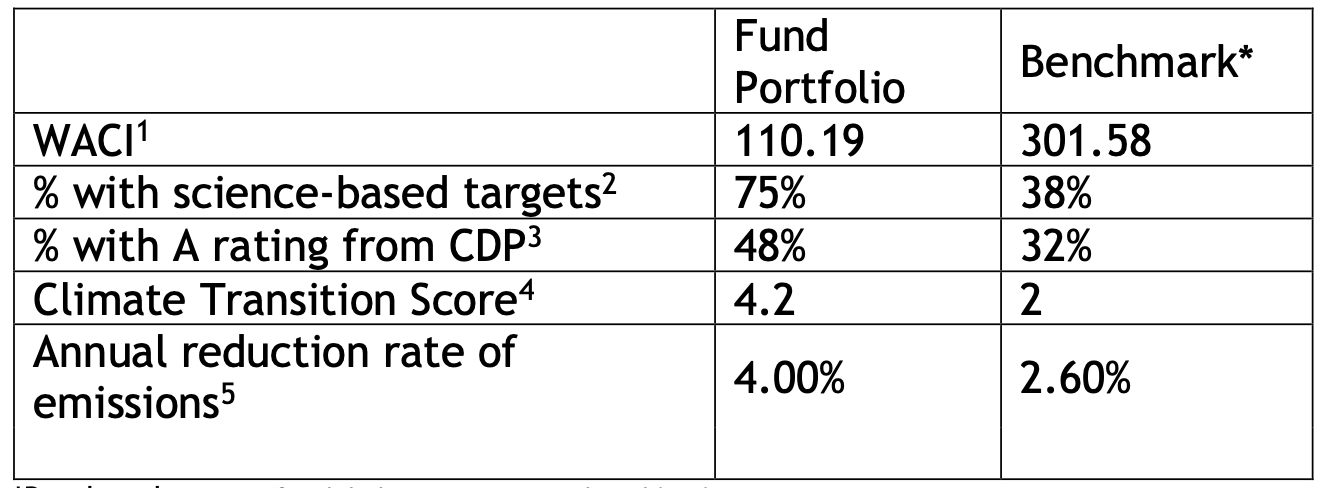

Transition to Net Zero Bond Fund vs. Benchmark

*Benchmark = ICE BofA Global Corporate & High Yield Index

1 Weighted Average Carbon Intensity [t CO2e/ USD M revenue].

2 Companies with science-based GHG reduction targets reviewed by independent parties (e.g. SBTi, CA100+).

3 Companies with leadership status regarding climate change according to CDP; at least 70% of scope 1 & 2 emissions verified and reported.

4 Weighted Average Climate Transition Score (responsAbility’s proprietary model).

5 Expected reduction rate of GHG emissions with reduction targets (linear annual rate).

Contact:

Philipp Good

ESG-AM

+41 43 817 76 06 philipp.good@esg-am.com

Stephanie Bilo

responsAbility Investments

+41 44 403 0553 stephanie.bilo@responsAbility.com

About ESG-AM AG

Founded in 2021, ESG-AM AG focuses as a FINMA regulated asset manager on a concentrated service and product offering for sustainable investments. Based on its expertise in credit, ESG-AM invests not only in companies that are already sustainability champions, but equally in those companies with the greatest catch-up potential as well as those with explicit impact. While building on partnerships for data sourcing, ESG-AM relies on in-house developed models and state-of-the-art technology for analysis. The company, headquartered in Zurich, Switzerland, addresses an institutional client base that wants to make their portfolios measurably sustainable and requires customized, specialized investment solutions to do so.

About responsAbility Investments AG

responsAbility is a leading impact investor focused on private debt and private equity across emerging markets. Founded in 2003 and headquartered in Zurich, it has invested over USD 12 billion since inception and has a strong performance track record. With over 200 employees, collaborating from seven offices, the company invests across three distinctive themes to directly contribute to the United Nations Sustainable Development Goals (SDGs): Financial Inclusion, to finance the growth of Micro & SMEs; Climate Finance, to contribute to a net zero pathway; and Sustainable Food, to sustainably feed an ever-growing population. responsAbility is part of M&G plc, the international savings and investments business, and contributes to enhancing M&G’s capabilities in impact investing.

Diese Publikation dient ausschliesslich der Information. Der Inhalt der Publikation wurde mit grösster Sorgfalt erstellt. Die in der vorliegenden Publikation enthaltenen Fakten und Meinungen können jederzeit und ohne vorherige Ankündigung ändern. Die ESG-AM AG lehnt jede Haftung ab, die sich aus der Nutzung oder Nichtnutzung der dargebotenen Information ergeben kann. Die Reproduktion oder Modifikation ganz oder teilweise ohne vorherige schriftliche Zustimmung der ESG-AM AG ist untersagt. Alle Rechte für diese Publikation bleiben vorbehalten. “ESGAM” und “ESG- AM” sind eingetragene und geschützte Marken.